By InnerKwest Fintech Desk | February 3, 2026

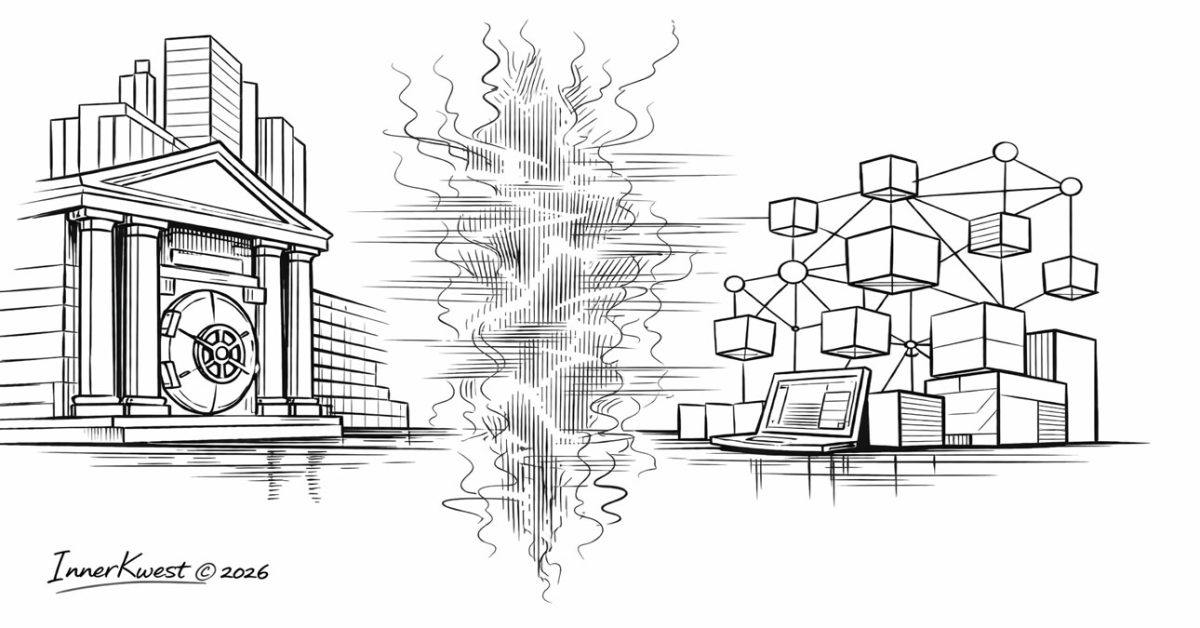

The clash between legacy banking power and crypto-native finance is no longer theoretical. It is now visible, personal, and increasingly political.

When The Wall Street Journal recently characterized Brian Armstrong, CEO of Coinbase, as “Enemy No. 1 on Wall Street,” it crystallized what had been quietly unfolding for years: a full-spectrum resistance campaign by the banking establishment against crypto platforms that threaten its deposit dominance.

What followed was not merely a headline—but a confrontation, a lobbying escalation, and a coordinated narrative strategy that now defines the fight over U.S. crypto regulation.

A Davos Moment That Exposed the Fracture

At the World Economic Forum in Davos, tensions that typically remain behind closed doors surfaced publicly. Multiple accounts confirm that Jamie Dimon, CEO of JPMorgan Chase and a longtime crypto skeptic, confronted Armstrong directly—interrupting a conversation and accusing him of misleading the public.

The episode was notable not just for its tone, but for what it symbolized: Wall Street’s most powerful banking executive openly challenging the legitimacy of a regulated, publicly listed crypto exchange CEO on the global stage.

This was not a debate over technology. It was a defense of incumbency.

The Clarity Act and the Deposit War No One Admits Is Happening

At the center of the conflict lies proposed U.S. crypto legislation often referred to as the Clarity Act—a framework intended to define regulatory boundaries for digital assets, stablecoins, and crypto intermediaries.

While framed publicly as a consumer-protection effort, the fiercest opposition from major banks has focused on one issue: capital flow.

Specifically:

- Stablecoins offering yield

- Crypto platforms acting as quasi-custodians

- The erosion of low-cost bank deposits

These are not abstract risks. They strike at the foundation of fractional-reserve banking, where deposits are leverage.

Misinformation as Strategy: The New Banking FUD

What has emerged alongside legislative resistance is a familiar pattern in financial history: Fear, Uncertainty, and Doubt—manufactured at scale.

Key narratives promoted by banking-aligned voices include:

- Claims that crypto platforms inherently endanger financial stability

- Assertions that stablecoin yields are “unregulated shadow banking”

- Implications that retail users are uniquely unsafe outside traditional banks

What is often omitted:

- Many crypto platforms now operate under clearer disclosure regimes than banks did prior to 2008

- Stablecoins are frequently over-collateralized, not under-reserved

- Banks themselves routinely engage in maturity mismatches far riskier than on-chain settlement models

This asymmetry is not accidental. It is strategic.

Why Coinbase Became the Target

Coinbase is not the largest crypto exchange globally. It is not the most aggressive. It is not the least compliant.

It is, however:

- U.S.-based

- Publicly listed

- Transparent

- Politically active

That combination makes it both visible and vulnerable.

By positioning Coinbase as the embodiment of crypto risk, banking interests gain a proxy through which to slow an entire sector—without confronting the broader technological shift they cannot reverse.

A Structural Conflict, Not a Moral One

This is not a story about heroes and villains. It is a story about power defending itself.

Banks are not irrational to resist crypto. They are responding to a real existential threat: the unbundling of money from institutions that have controlled it for a century.

But when that resistance crosses into narrative manipulation—when concern becomes distortion—the public deserves clarity about who benefits from the confusion.

The Question Regulators Must Answer

As lawmakers debate crypto’s future, the central question is no longer whether digital assets belong in the financial system.

They already are.

The question is whether regulation will:

- Protect consumers and competition

- Or entrench incumbents behind the language of safety

History suggests the outcome depends not on technology—but on who controls the story.

InnerKwest Perspective

Participation without ownership is extraction.

Innovation without clarity is chaos.

But protectionism disguised as prudence is something else entirely.

And it deserves scrutiny.

At InnerKwest.com, we are committed to delivering impactful journalism, deep insights, and fearless social commentary. Your cryptocurrency contributions help us execute with excellence, ensuring we remain independent and continue to amplify voices that matter.

To help sustain our work and editorial independence, we would appreciate your support of any amount of the tokens listed below. Support independent journalism:

BTC: 3NM7AAdxxaJ7jUhZ2nyfgcheWkrquvCzRm

SOL: HxeMhsyDvdv9dqEoBPpFtR46iVfbjrAicBDDjtEvJp7n

ETH: 0x3ab8bdce82439a73ca808a160ef94623275b5c0a

XRP: rLHzPsX6oXkzU2qL12kHCH8G8cnZv1rBJh TAG – 1068637374

SUI – 0xb21b61330caaa90dedc68b866c48abbf5c61b84644c45beea6a424b54f162d0c

and through our Support Page.

InnerKwest maintains a revelatory and redemptive discipline, relentless in advancing parity across every category of the human experience.