An InnerKwest Analysis | January 8, 2026

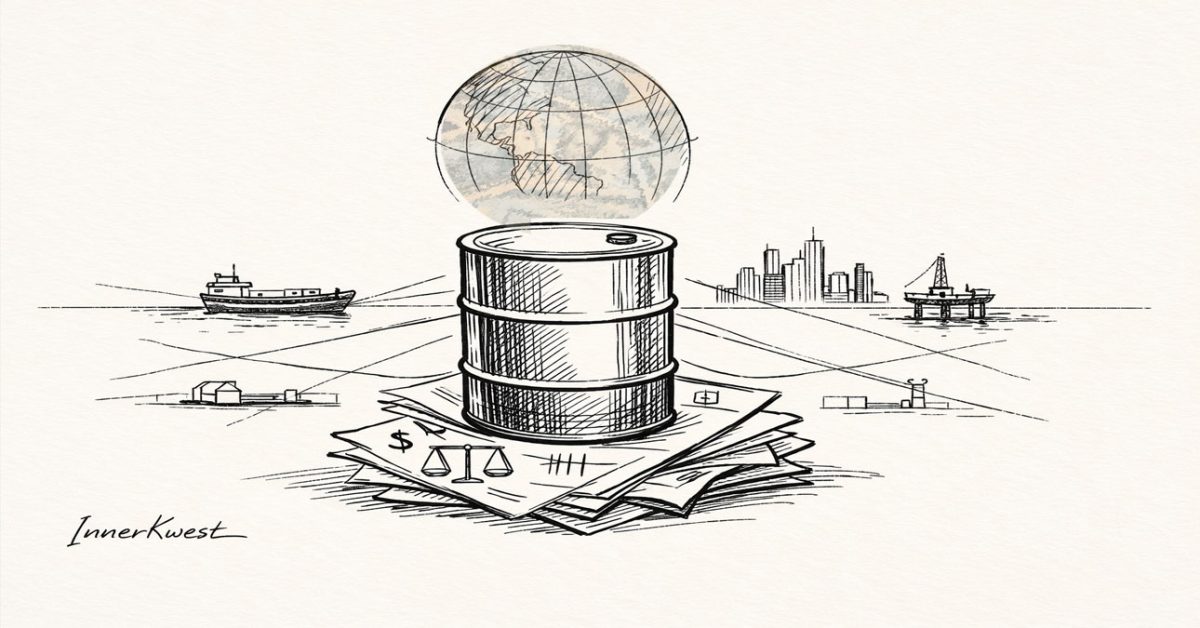

For more than half a century, the dominance of the U.S. dollar has rested not on gold, productivity, or trust alone—but on oil. The petrodollar system, born in crisis and maintained through discipline, has shaped wars, sanctions, alliances, and silence. This is its story—from origin to present-day strain.

The Collapse That Forced Reinvention (1971–1974)

In August 1971, Richard Nixon severed the U.S. dollar from gold. The Bretton Woods system—already fraying under the weight of war spending and global imbalances—collapsed overnight. What remained was a paradox: the United States still issued the world’s reserve currency, but no longer backed it with anything tangible.

This presented an existential problem.

A fiat currency without compulsory demand is vulnerable. Confidence can wane. Alternatives can emerge.

What followed was not accidental innovation, but strategic necessity.

By 1974, Washington had engineered a solution with Saudi Arabia, the world’s most influential oil producer. The agreement was simple in structure, profound in consequence:

- Saudi oil would be priced exclusively in U.S. dollars

- Surplus oil revenues would be recycled into U.S. Treasuries

- The U.S. would provide military protection, arms, and regime security

Soon, the arrangement expanded across OPEC. Oil—the world’s most indispensable commodity—became inseparable from the dollar.

The petrodollar was born.

Oil as Monetary Gravity

Once oil was dollar-denominated, the implications were global and unavoidable.

Every nation that needed energy now needed dollars.

Every trade imbalance funneled capital back toward U.S. financial markets.

Every oil shock increased—not reduced—demand for U.S. currency.

This created a feedback loop:

- Persistent U.S. deficits became sustainable

- Treasury markets absorbed global surpluses

- Military and diplomatic reach could expand without immediate domestic cost

The petrodollar did not merely support the dollar—it institutionalized dependence.

Enforcement Without Declaration

Unlike empires of the past, the petrodollar order did not require constant conquest. Its enforcement mechanisms were largely financial, legal, and procedural.

Institutions such as the International Monetary Fund and the World Bank provided liquidity—but often on terms aligned with dollar primacy. Payment systems, correspondent banking, and clearing infrastructure reinforced the architecture.

When persuasion failed, pressure followed:

- Sanctions

- Asset freezes

- Trade exclusion

- Secondary sanctions against allies

Force was never the first option—but it was always implicit.

The Cost of Defiance: A Repeating Pattern

History reveals a consistent response to oil-producing states that attempted monetary independence.

Iraq

In the early 2000s, Saddam Hussein announced plans to sell Iraqi oil in euros. The move was symbolic more than systemic—but it challenged precedent. Within years, Iraq was invaded. The euro experiment ended quietly.

Libya

Muammar Gaddafi proposed a gold-backed African dinar to facilitate oil trade across the continent. It threatened not just dollar settlement, but African monetary sovereignty. NATO intervention followed. Libya collapsed into fragmentation.

Iran

Efforts to establish non-dollar oil bourses triggered decades of sanctions, financial isolation, and economic warfare—without formal declaration of war.

Russia

Energy trade diversification accelerated after 2014. Following Ukraine, Russia faced unprecedented sanctions, including reserve seizures that sent shock-waves through central banks globally.

The pattern does not require conspiracy. It requires consistency.

Venezuela: Pressure in the Modern Era

No contemporary case better illustrates petrodollar enforcement under modern conditions than Venezuela.

Venezuela holds the largest proven oil reserves on Earth. Over the past decade, it has experimented—unevenly and imperfectly—with:

- Non-dollar oil settlement

- Energy trade in euros and yuan

- State-backed crypto instruments

- Reduced reliance on U.S. financial infrastructure

The response has been layered rather than dramatic:

- Sanctions on PDVSA

- Asset seizures, including CITGO

- Diplomatic recognition maneuvers

- Financial isolation framed as governance correction

Notably, this pressure has unfolded without sustained media focus on currency implications. The mechanics are technical. The visibility is minimal. The enforcement is effective.

Silence as Strategy

The petrodollar system does not thrive on spectacle. It thrives on managed normalcy.

Crises that do not threaten currency settlement dominate headlines.

Crises that do are handled quietly—through licenses, waivers, sanctions, and regulatory signals.

This is not distraction by design. It is attention asymmetry by structure.

Markets require calm.

Confidence requires continuity.

Dollar dominance requires that challenges appear isolated, technical, and containable.

Strain in a Multi-polar World

Today, the petrodollar faces pressures not seen since its inception.

- BRICS nations are exploring non-dollar trade settlement

- China has negotiated oil contracts in yuan

- Regional payment systems are expanding

- Central banks are quietly reassessing reserve composition

The threat is not an overnight collapse—but erosion of compulsion.

If oil no longer requires dollars:

- Treasury demand weakens

- Deficit financing tightens

- Power projection becomes cost-visible

The system’s resilience lies not in permanence, but in inertia.

The Question Beneath the System

The petrodollar has delivered decades of relative global stability—at a price rarely itemized.

It has funded prosperity for some, discipline for others, and silence where scrutiny might otherwise grow.

The unresolved question is not whether the system worked.

It is whether a world entering multi-polar reality can sustain a monetary order built on unilateral enforcement.

And whether nations—long accustomed to paying the toll—will continue to do so quietly.

The Cost of Normalcy

The petrodollar was never just about oil. It was about who sets the terms of survival in a resource-dependent world. As those terms are renegotiated, the system does not announce its defense. It simply applies pressure—where attention is lowest, and consequences are highest.

Support InnerKwest: Powering Truth & Excellence with Bitcoin

At InnerKwest.com, we are committed to delivering impactful journalism, deep insights, and fearless social commentary. Your Bitcoin contributions help us execute with excellence, ensuring we remain independent and continue to amplify voices that matter.

Support our mission—send BTC today!

🔗 Bitcoin Address: 3NM7AAdxxaJ7jUhZ2nyfgcheWkrquvCzRm© 2026 InnerKwest®. All Rights Reserved | Haki zote zimehifadhiwa | 版权所有.

InnerKwest® is a registered trademark of Inputit™ Platforms Inc. Global

No part of this publication may be reproduced, distributed, or transmitted in any form or by any means without prior written permission. Unauthorized use is strictly prohibited.

Thank you for standing with us in pursuit of truth and progress!![]()