By InnerKwest Fintech Desk | February 4, 2026

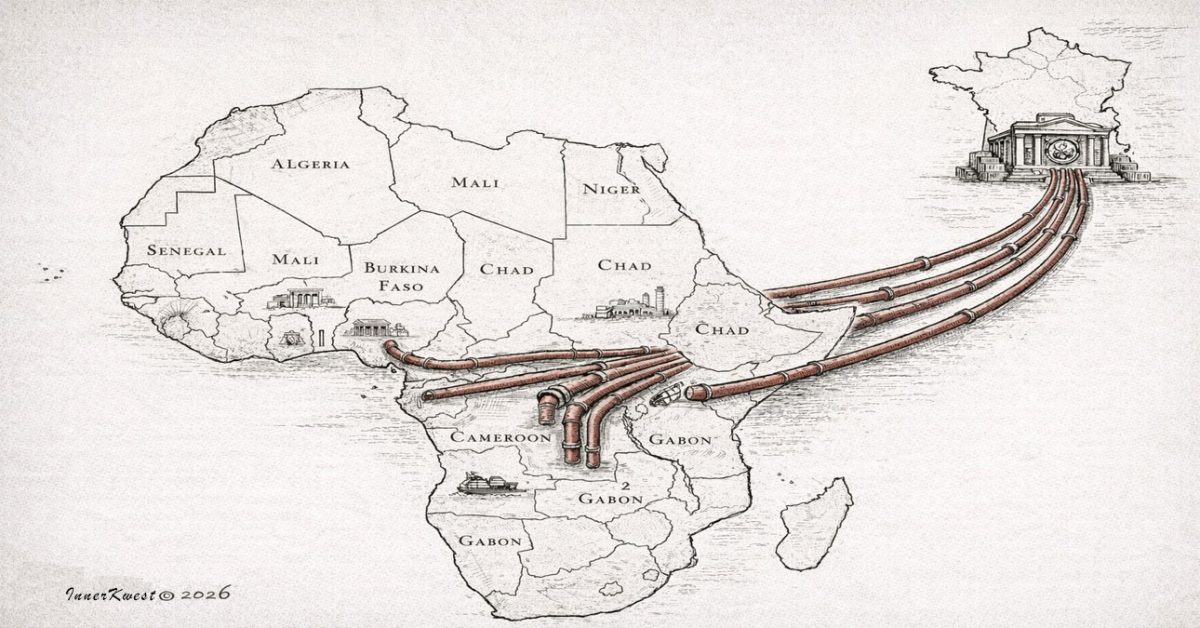

From Dakar to Yaoundé, an uncomfortable truth binds more than 200 million Africans across West and Central Africa: their money is not fully theirs.

More than six decades after formal independence, fourteen African nations still use a currency conceived during colonial rule, managed under foreign constraints, and anchored to European financial power. Known as the CFA franc, it remains one of the most enduring—and least discussed—mechanisms of neocolonial control in the modern global economy.

This is not a historical footnote. It is an active system with real consequences: suppressed sovereignty, constrained development, and futures deferred.

A Currency Designed Elsewhere

The CFA franc was created in 1945 by the French government, not as a neutral monetary tool, but as an administrative instrument to manage colonial economies in service of Paris.

Today, countries such as Senegal, Cameroon, Côte d’Ivoire, Mali, Burkina Faso, and others remain locked into two CFA zones—West African and Central African—whose currencies are guaranteed, and effectively overseen, by France.

Key features of the system remain extraordinary by modern standards:

- A fixed peg to the euro

- Mandatory reserve deposits historically held in the French Treasury

- Limited independent monetary policy

- External veto power over currency adjustments

This is not how sovereign money typically functions.

Independence in Name, Constraint in Practice

Supporters of the CFA system argue that it provides stability, low inflation, and investor confidence. And on paper, these claims are not entirely unfounded.

But stability without sovereignty comes at a cost.

CFA countries cannot freely:

- Devalue their currency to support exports

- Expand money supply in response to domestic needs

- Use monetary policy as a development tool

In effect, fiscal policy is national—but monetary power is outsourced.

For economies attempting industrialization, this is not a minor limitation. It is a structural ceiling.

The Hidden Price: Poverty, Debt, and Missed Futures

While CFA-zone nations possess vast natural resources—oil, cocoa, uranium, gold, timber—their economic outcomes tell a different story.

Many remain:

- Exporters of raw materials

- Importers of finished goods

- Dependent on foreign capital

- Vulnerable to external shocks

The result is a cycle of trade imbalance, mounting debt, and youth unemployment—conditions that fuel migration, instability, and political frustration.

Currency design does not explain everything. But it explains more than is often admitted.

Why the CFA Franc Endures

If the system is so controversial, why does it persist?

The answer lies in asymmetry of power.

France retains strategic influence in:

- African financial systems

- Central bank governance structures

- International backing for the CFA model

Meanwhile, political elites within some CFA countries benefit from access, predictability, and external support—even as broader populations bear the long-term costs.

Change threatens entrenched interests on both sides.

Reform, Resistance, and the Road Ahead

In recent years, resistance has grown louder. Protests, academic critiques, and political movements across Africa have increasingly challenged the legitimacy of the CFA system.

Reforms have been proposed—rebranding, reserve adjustments, new names—but critics argue these are cosmetic, not structural.

True monetary independence would require:

- National or regional currencies under African control

- Autonomous central banking

- Policy flexibility aligned with development goals

Anything less risks preserving the architecture of dependence under a new label.

Rebranded Exploitation

Colonialism did not disappear—it adapted.

The CFA franc is not enforced by soldiers or governors, but by treaties, technocrats, and financial norms that appear neutral while reproducing inequality.

This is not independence.

It is managed autonomy.

And the price is paid in lost decades.

Until African nations fully control their money, the promise of post-colonial sovereignty will remain unfinished business.

The Larger Implications

Power does not always announce itself.

Sometimes it hides in exchange rates, reserve rules, and who gets the final signature.

The future of Africa will not be decided by aid or rhetoric—but by who controls the fundamentals of its economy.

Currency is one of them.

At InnerKwest.com, we are committed to delivering impactful journalism, deep insights, and fearless social commentary. Your cryptocurrency contributions help us execute with excellence, ensuring we remain independent and continue to amplify voices that matter.

To help sustain our work and editorial independence, we would appreciate your support of any amount of the tokens listed below. Support independent journalism:

BTC: 3NM7AAdxxaJ7jUhZ2nyfgcheWkrquvCzRm

SOL: HxeMhsyDvdv9dqEoBPpFtR46iVfbjrAicBDDjtEvJp7n

ETH: 0x3ab8bdce82439a73ca808a160ef94623275b5c0a

XRP: rLHzPsX6oXkzU2qL12kHCH8G8cnZv1rBJh TAG – 1068637374

SUI – 0xb21b61330caaa90dedc68b866c48abbf5c61b84644c45beea6a424b54f162d0c

and through our Support Page.

InnerKwest maintains a revelatory and redemptive discipline, relentless in advancing parity across every category of the human experience.

© 2026 InnerKwest®. All Rights Reserved | Haki zote zimehifadhiwa | 版权所有. InnerKwest® is a registered trademark of Inputit™ Platforms Inc. Global No part of this publication may be reproduced, distributed, or transmitted in any form or by any means without prior written permission. Unauthorized use is strictly prohibited. Thank you for standing with us in pursuit of truth and progress!