How the CLARITY Act Debate Exposed the Deeper Struggle Over Crypto, Power, and Asymmetric Justice

By InnerKwest Capital Desk | January 24, 2026

Crypto was never conceived as an accessory to the existing financial system. It emerged as a response to it.

Not as a product category.

Not as a regulatory carve-out.

But as a structural alternative to a world shaped by repeated financial crises, selective accountability, and laws that consistently protect institutions while disciplining individuals.

That is why the current debate surrounding the CLARITY Act matters—even before the bill has passed. Especially because it has not.

The CLARITY Act’s Senate markup was delayed after public and substantive opposition, most notably following Coinbase’s rejection of major provisions in the bill’s current form. That delay was not procedural noise. It was a rupture. It exposed unresolved tensions that had been obscured by the language of “market structure” and “clarity.”

This moment is not about regulatory housekeeping.

It is about whether crypto’s foundational challenge to legacy finance will be absorbed, constrained, or reshaped beyond recognition.

The Illusion of Neutrality

Legislative language often performs reassurance before it performs regulation. “Clarity” suggests order, predictability, and protection. It implies that uncertainty is the enemy and that centralized authority is the remedy.

But history offers a more sobering lesson: clarity for institutions frequently becomes constraint for everyone else.

Financial regulation does not operate in a vacuum. It reflects incentives, power distributions, and historical bias. When a new system threatens entrenched intermediaries, regulation rarely arrives as prohibition. It arrives as normalization—rules that require the new system to behave like the old one.

That is the unspoken tension embedded in the CLARITY Act debate. The question is not whether crypto should be regulated. The question is whether regulation will enable new systems on their own terms, or force them into frameworks designed to preserve existing hierarchies.

Old Laws, New Systems, Permanent Consequences

Much of the unease surrounding the CLARITY Act stems from a structural mismatch that has defined U.S. financial regulation for decades.

Twentieth-century securities law was designed for:

- Centralized issuers

- Linear disclosure

- Paper-based instruments

- National jurisdiction

- Human intermediaries

Crypto systems operate on entirely different assumptions:

- Decentralized protocols

- Open-source composability

- Automated, algorithmic settlement

- Global participation

- Non-custodial control

When laws built for the former are stretched to govern the latter, regulation stops being adaptive and becomes reductive. Innovation is not guided—it is narrowed.

And once that narrowing is written into statute, it hardens. Courts defer to agencies. Agencies build enforcement culture. Precedent accumulates. What begins as “temporary clarity” becomes permanent structure.

This is why timing matters. Because bad law does not expire when administrations change. It survives them.

The Stablecoin Fault Line

One of the most consequential points of friction in the CLARITY Act debate lies beneath the surface of public discussion: stablecoins.

Stablecoins are not merely digital representations of dollars. At scale, they represent an alternative settlement and savings logic—instant, global, programmable, and low-cost. When stablecoin balances begin to resemble yield-bearing or reward-based instruments, they challenge a core pillar of legacy finance: the bank deposit monopoly.

From that vantage point, resistance becomes predictable.

Limit the economics.

Constrain the design.

Restrict the functionality.

This does not require banning stablecoins outright. It only requires regulating them until they no longer compete.

When market-structure legislation neutralizes the features that make stablecoins disruptive, the effect is not consumer protection. It is incumbent preservation.

Who Holds the Key

Regulation is not merely about enforcement. It is about definition.

The agency empowered to decide what a digital asset is effectively determines what it can become. Market-structure bills allocate not just oversight, but epistemic authority—the power to classify, interpret, and constrain.

When interpretive authority consolidates under frameworks historically hostile to decentralization, builders face a familiar reality: innovation becomes legally precarious by default. Only entities with substantial legal and political capital can operate with confidence. Everyone else navigates ambiguity as risk.

This does not eliminate crypto.

It reshapes it into something safer for existing power structures—permissioned, surveilled, and slow.

Privacy as a Casualty of Design

Privacy rarely disappears through explicit bans. It disappears through incompatibility.

Compliance regimes designed around centralized intermediaries assume traceability at every layer. When that assumption is imposed on decentralized systems, privacy becomes indistinguishable from suspicion.

The result is not balance. It is inversion.

Individuals are expected to be fully transparent, while institutions with decades-long histories of misconduct remain structurally shielded. Privacy shifts from a civil norm to a regulatory liability.

This is not a neutral outcome. It reflects whose behavior is trusted—and whose is not.

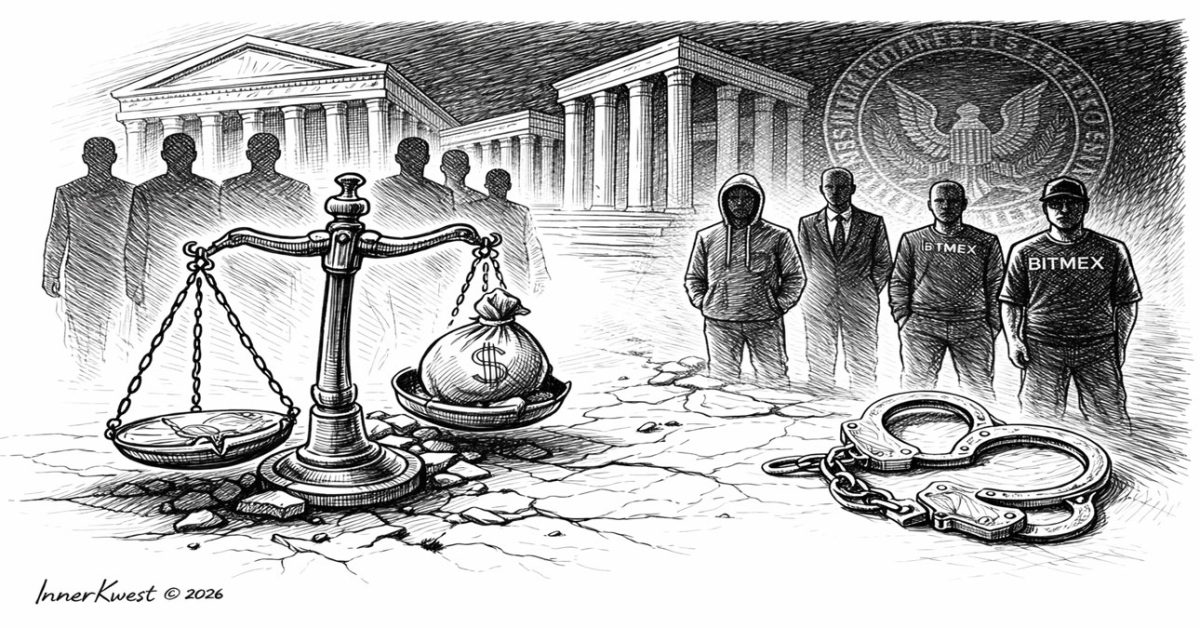

The BITMEX Lesson and the Problem of Asymmetric Justice

No analysis of crypto regulation is complete without confronting the memory that continues to shape the industry’s posture toward lawmakers: the BITMEX case.

This is not a debate about innocence or guilt. Courts resolved that question. The relevance lies elsewhere—in what the episode revealed about how justice is applied, and to whom.

The BITMEX founders faced criminal charges, personal liability, and public sanction. The message was unmistakable: individuals who build disruptive financial infrastructure without institutional shelter are directly exposed to the full force of the state.

Contrast that with the parallel reality of the same era.

Major global banks were repeatedly implicated in money laundering at scales measured in billions of dollars. The outcomes were familiar: deferred prosecution agreements, fines absorbed as operating expenses, no executive prison sentences, uninterrupted operations.

This asymmetry is not incidental. It is structural.

The distinction is not between legality and illegality. It is between disruption and incumbency.

When misconduct occurs inside institutions deemed systemically important, the system bends to preserve continuity. When misconduct occurs within structures that threaten incumbents, enforcement becomes exemplary.

The lesson absorbed by innovators was clear:

- Build within the system, and penalties are negotiable.

- Build against the system, and penalties are personal.

That memory did not fade. It calcified.

This is why assurances of neutral “clarity” are met with skepticism. Regulation is judged not by rhetoric, but by enforcement history. And that history demonstrates that new rules rarely fall evenly across participants.

When market-structure legislation extends the reach of the same enforcement philosophy that produced this imbalance, concern is rational—not ideological.

Why the Delay Matters

The postponed markup disrupted momentum. It interrupted the quiet march from proposal to inevitability.

Legislation often succeeds not because it is settled, but because opposition fragments while timelines advance. The public rejection of key provisions by a major industry participant fractured that process and forced a pause.

That pause matters. Not because it guarantees a better outcome—but because it briefly exposes the unresolved power struggle beneath the surface.

Once negotiations retreat behind closed doors, clarity rarely increases.

A Familiar Pattern

This is not a new story.

Railroads.

Telecommunications.

The internet.

Each transformative infrastructure faced a moment when regulation determined whether it would remain open or become gated. The vocabulary changed. The mechanisms evolved. The pattern endured.

First comes innovation.

Then adoption.

Then concern.

Then regulation.

Then capture—unless resistance is precise and sustained.

Crypto now stands at that inflection.

What Is at Stake

This debate is not about whether crypto will exist. It will.

The question is what kind of system it becomes:

- An open network constrained by abuse but governed by transparent rules, or

- A regulated replica of legacy finance, rebuilt on new rails but shaped by old priorities

The difference determines who controls value, who bears risk, who enjoys privacy, and who is protected when failures occur.

The Enduring Warning

Political administrations change. Legislative language endures.

Once enacted, bad law does not quietly disappear. It accumulates precedent. It shapes enforcement. It defines reality for decades.

That is why the current delay should not be mistaken for resolution. It is a narrow opening—perhaps the last—to confront the underlying issue honestly.

Clarity can illuminate.

But it can also confine.

And history shows that when clarity is designed to make new systems legible only on old terms, it does not secure the future.

It captures it.

Because bad law outlives bad administrations—and the systems forced to live under it rarely get a second chance.

At InnerKwest.com, we are committed to delivering impactful journalism, deep insights, and fearless social commentary. Your cryptocurrency contributions help us execute with excellence, ensuring we remain independent and continue to amplify voices that matter.

To help sustain our work and editorial independence, we would appreciate your support of any amount of the tokens listed below. Support independent journalism:

BTC: 3NM7AAdxxaJ7jUhZ2nyfgcheWkrquvCzRm

SOL: HxeMhsyDvdv9dqEoBPpFtR46iVfbjrAicBDDjtEvJp7n

ETH: 0x3ab8bdce82439a73ca808a160ef94623275b5c0a

XRP: rLHzPsX6oXkzU2qL12kHCH8G8cnZv1rBJh TAG – 1068637374

SUI – 0xb21b61330caaa90dedc68b866c48abbf5c61b84644c45beea6a424b54f162d0c

and through our Support Page.

InnerKwest maintains a revelatory and redemptive discipline, relentless in advancing parity across every category of the human experience.

© 2026 InnerKwest®. All Rights Reserved | Haki zote zimehifadhiwa | 版权所有. InnerKwest® is a registered trademark of Inputit™ Platforms Inc. Global No part of this publication may be reproduced, distributed, or transmitted in any form or by any means without prior written permission. Unauthorized use is strictly prohibited. Thank you for standing with us in pursuit of truth and progress!