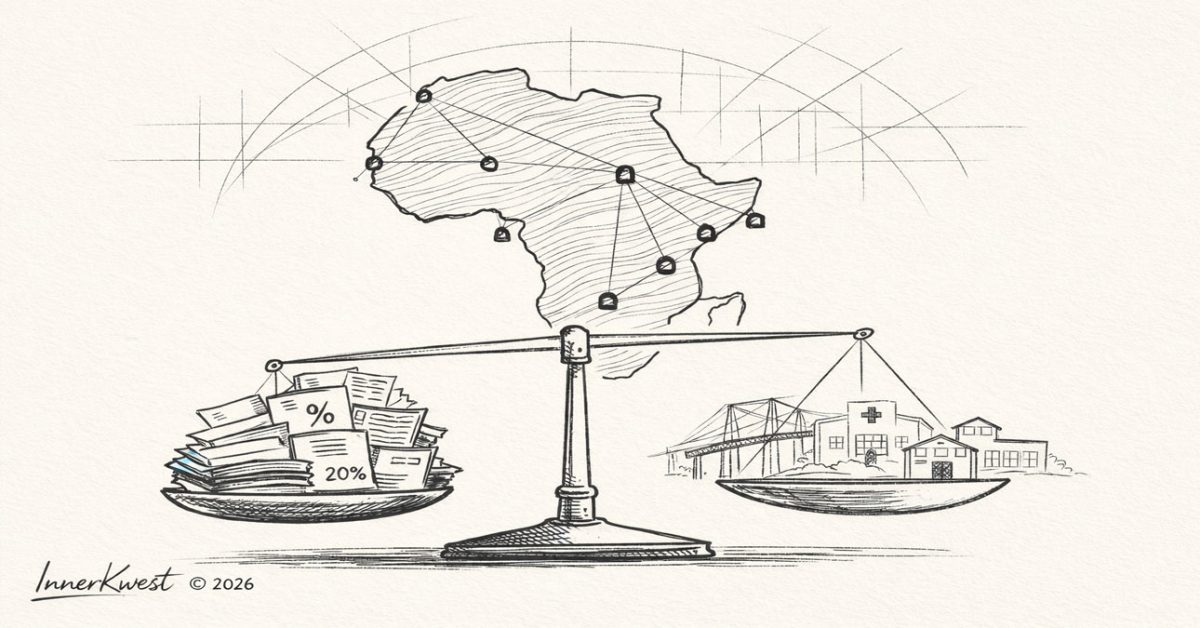

African nations routinely pay the highest borrowing costs in the global financial system, even when their economic fundamentals mirror those of countries elsewhere. This investigation examines how global risk models, banking regulations, and debt-service structures combine to price geography before performance—quietly constraining development, infrastructure, and long-term growth across the continent.

The New Cartography of African Sovereignty

By InnerKwest Editorial-Research Desk • August 16, 2025 Executive Summary Across Africa, sovereignty functions on a spectrum—pulled by foreign military footprints and air operations, hard-currency pegs and IMF programs, port leases and security pacts, and recognition politics. This report maps where external levers are strongest right now and explains how they translate into day-to-day constraints on government choices. Vectors of …

The Invisible Leash on the African Union

How Soft Power, Foreign Influence, and Internal Fractures Constrain Africa’s Pursuit of True Sovereignty By InnerKwest Editorial At first glance, the African Union (AU) is the proud symbol of a continent rising. Its marble halls, diplomatic summits, and bold declarations reflect the aspirations of over a billion people seeking unity, development, and self-determination. But beneath the surface, a complex web …