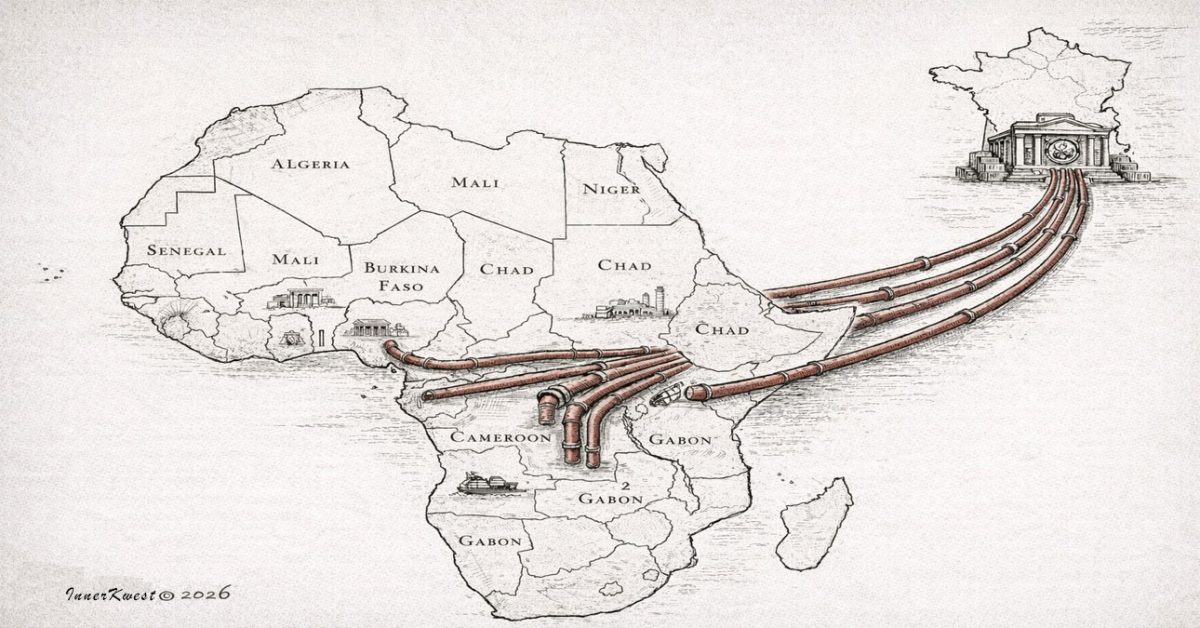

More than sixty years after independence, millions of Africans still use a currency designed and constrained outside the continent. The CFA franc reveals how colonial power adapts rather than disappears.

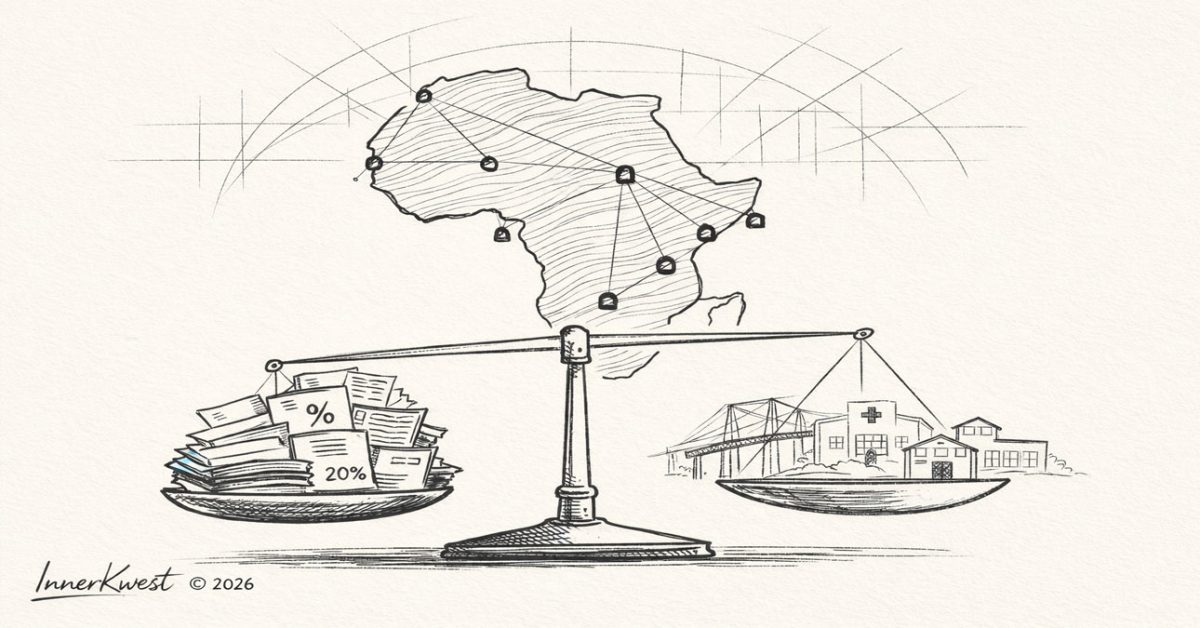

The Price of Proximity: How Global Finance Makes Africa Pay More to Borrow

African nations routinely pay the highest borrowing costs in the global financial system, even when their economic fundamentals mirror those of countries elsewhere. This investigation examines how global risk models, banking regulations, and debt-service structures combine to price geography before performance—quietly constraining development, infrastructure, and long-term growth across the continent.

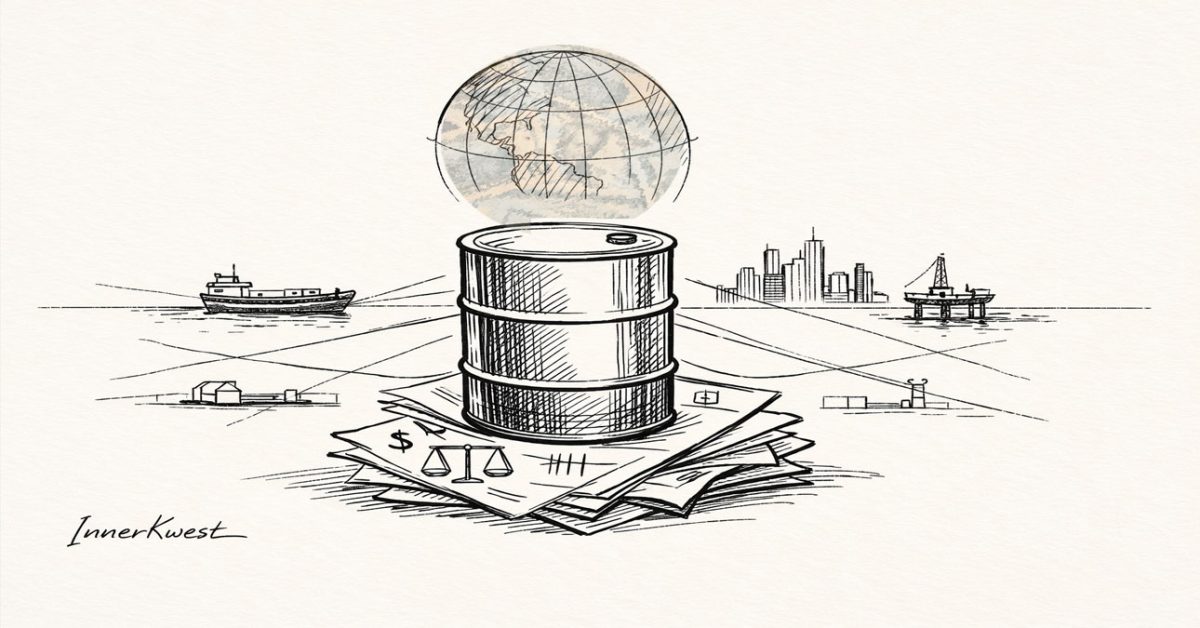

The Petrodollar Order: How Oil Became Currency and Power Became Enforcement

For more than half a century, global oil trade has quietly anchored the dominance of the U.S. dollar. Born from crisis and sustained through discipline, the petrodollar system reshaped markets, alliances, and enforcement without formal declaration. From its origins in the 1970s to modern sanctions and oil diplomacy, this investigation traces how currency power became one of the most consequential—and least examined—forces in global geopolitics.

Ghana’s Virtual Assets Act Is Not About Crypto

Ghana’s crypto law is not a regulatory milestone—it is a historical marker. From Bitcoin’s ungoverned origins to the institutional sealing of digital finance, a once-in-a-lifetime monetary reconstruction has already taken place. Now, as global standards harden and Africa is openly described as the next profitable frontier, the question is no longer about compliance. It is about timing, power, and whether Africa will enter this era as a sovereign architect of value—or as a well-regulated extraction zone in someone else’s financial endgame.